Table of Contents

Introduction:

India is a country that has more than 1.35 billion people from different religion, dialects, cuisines. India is second most populous country in the world and has more than 16% of total population of the world sharing approximately 2% of world’s landmass. Apart from hunger, homelessness is also a big problem in India. Government of India took a step forward in this direction and come up with a new scheme named Pradhan Mantri Awas Yojana. This scheme is meant to focus on providing budget homes to urban poors through government financing.

How Much Population of India is without House

Based on Tendulkar’s report on poverty line, there is about 29% of Indian living below poverty line. As per the report approximately 833 million people from rural areas often migrated to the urban areas in search of employment. As per 2011 census There is 0.9 million homeless people in urban India [Census 2011], in addition this there is approximately 65 million population that is living in slums in urban areas.

As we all are aware of the formalities being asked by the banks to provide home loans. You must have a piece of land and the building plan must be approved by the concerned municipality / Village Panchayat. Apart from this taking a loan from banks served as higher end facility.

Government of India Initiative for Housing Loan

On 25th June 2015 Govt. of India launched Pradhan Mantri Awas Yojana(PMAY) to provide budget homes to urban poors. As we are aware of Indian housing market, where on supply side increased cost of construction, lack of valuable land and master plan restraints hamper the growth of this sector, while on the demand side absence of cheaper loan, lower buying capacity also added to the woes of housing sector. In order to fall this sector in line with demand of the housing in urban sector, government of India on 25th June 2015 launched Pradhan Mantri Awas Yojna (PMAY) with a mission to provide housing for all by 2022, when India will celebrate its 75 Independence day.

How Does Government widen the Coverage Under Pradhan Mantri Awas Yojana (PMAY)

To achieve this objective government has adopted the multi facet stratergy

(A) “In-situ” Slum Redevelopment (ISSR): Slum redevelopment Central assistance of Rs.1 lakh per house is admissible for all houses built for eligible slum dwellers under the component of In-situ Slum Redevelopment (ISSR) using land as Resource with participation of private developers. This slum rehabilitation grants can be utilised by States/UTs for any of the slum redevelopment projects. After redevelopment, de-notification of slums by State/UT Government is recommended under the guidelines.

(B) Credit Linked Subsidy Scheme (CLSS): Interest Subsidy up to 2.67 lakh per house is admissible for Beneficiaries of Economically Weaker Section (EWS)/Low Income Group (LIG), Middle Income Group (MIG)-I and Middle Income Group (MIG)-II seeking housing loans from Banks, Housing Finance Companies and other such institutions for acquiring/constructing houses. The interest subsidies of 6.5%, 4% and 3% on loan amount up to Rs. 6 lakh, Rs. 9 lakh and Rs. 12 lakh are admissible for a house with carpet area of up to 60, 160 and 200 Sq.Meter for EWS/LIG, MIG I and MIG II respectively. The scheme for MIG category was up to 31st March 2019 which has been now extended up to 31st March 2020. The benefit for EWS/LIG beneficiaries under CLSS works out to as high as Rs. 6 lakh over a loan period of 20 years.

(C) Affordable Housing in Partnership (AHP): Central Assistance of Rs.1.5 Lakh per EWS house is provided by Government of India in projects where at least 35% of the houses in the projects are for EWS category and a single project has at least 250 houses.

(D) Beneficiary-led individual house construction/enhancements (BLC): Under this component, central assistance of Rs.1.5 lakh is available to individual eligible families belonging to EWS categories.

Who are Covered Under Pradhan Mantri Awas Yojana (PMAY)

Not all living in urban areas of India are covered under this scheme. Government of India has made the following as the beneficiaries of this scheme:

- A beneficiary family shall consist of Husband, wife and unmarried son or daughter.

- A beneficiary shall not own a permanent structure in his / her name in any part of the country.

- House will be registered in name of female head of the family or in joint registration with the male head of the family.

Criteria for Being Beneficiary of Pradhan Mantri Awas Yojana(PMAY)

This scheme is launched to provide budget homes to urban poors. For this purpose, residents with low income in urban areas are divided into 3 groups with fixed carpet area, however states have been given flexibility to increase the carpet area in due consultation and approval of ministry.

- Economically Weaker Section(EWS): This group include those persons who have their annual income less than 3 lakhs.

- Low Income Group(LIG): This group include those persons who have their annual income ranges between 3-6 lakhs.

- Middle Income Group – I(MIG-I):This group include those persons who have their annual income ranges between 6-12 lakhs.

- Middle Income Group – II(MIG-II):This group include those persons who have their annual income ranges between 12-18 lakhs.

How Much Government Assistance will be Provided

- In case of Economically Weaker Section full assistance will be provided to the beneficiary.

- In case of Low Income Group and Middle Income Group beneficiary will be benefited under Credit Linked Subsidy Scheme

What is Maximum Loan Amount Under Pradhan Mantri Awas Yojana(PMAY)

- Economically Weaker Section – Fixed 6 Lakhs for a carpet area of 325 sq.ft. or 30 sq.mt. with 6.5% Rate of Interest, with 20 years of repayment. Government will pay a maximum of Rs. 2.67 Lakhs subsidy to the beneficiary.

- Low Income Group – Fixed 6 Lakhs for a carpet area of 650 sq.ft. or 60 sq.mt. with 6.5% Rate of Interest, with 20 years of repayment. Government will pay a maximum of Rs. 2.67 Lakhs subsidy to the beneficiary.

- Middle Income Group – I – Fixed 6 Lakhs for a carpet area of 1720 sq.ft. or 160 sq.mt. with 4.0 % Rate of Interest, with 20 years of repayment. Government will pay a maximum of Rs. 2.35 Lakhs subsidy to the beneficiary.

- Middle Income Group – II – Fixed 6 Lakhs for a carpet area of 2150 sq.ft. or 200 sq.mt. with 3.0 % Rate of Interest, with 20 years of repayment. Government will pay a maximum of Rs. 2.35 Lakhs subsidy to the beneficiary.

Who Can Apply for Pradhan Mantri Awas Yojana(PMAY)

The following will be considered for being beneficiary of Pradhan Mantri Awas Yojana(PMAY)

- Any citizen of India can apply under Pradhan Mantri Awas Yojana(PMAY).

- Any House hold with annual income from 3 lakhs to 18 lakhs. To raise the eligibility from one group to another, individual is allowed to include the income of spouse as well.

- Only construction of new house is allowed under Pradhan Mantri Awas Yojana(PMAY), no renovation is allowed under Pradhan Mantri Awas Yojana(PMAY).

- Individual shall not have any house under his name registered in any part of the country.

- Preferences for the ground floor will be accorded to the senior citizen and specially abled persons.

How to Apply for Pradhan Mantri Awas Yojana(PMAY)

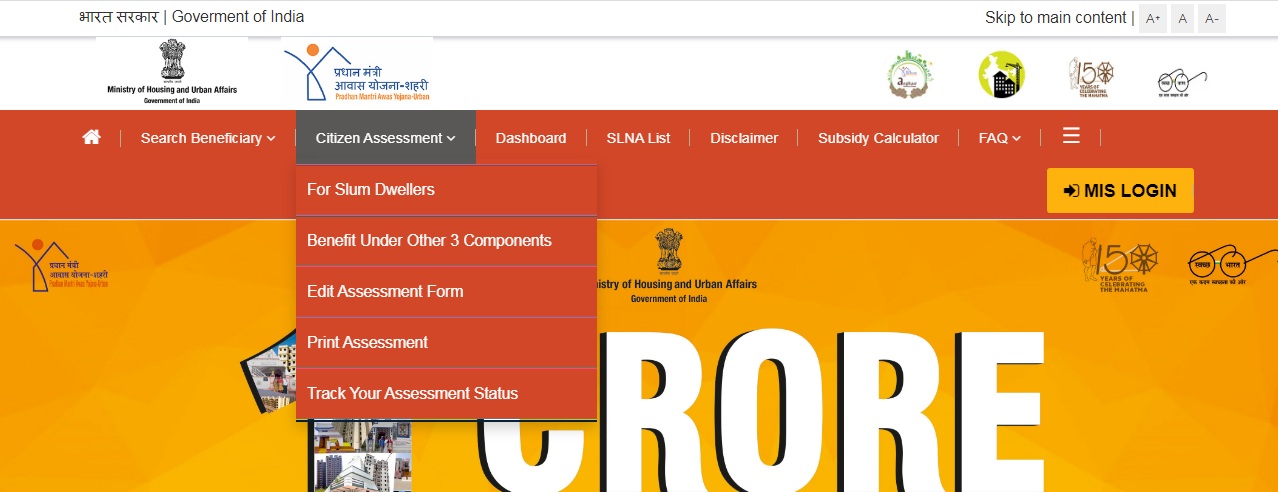

- Visit http://pmaymis.gov.in/

- From citizen assessment, click on slum dwellers or other components.

- Verify yourself by entering your aadhar no. and name, then accept terms and conditions and then press check

- Enter your details and submit the form.

- After submission we can check it current assessment status from citizen assessment drop down menu.

2 thoughts on “Pradhan Mantri Awas Yojna – Affordable Home Loan for Urban Poors”